The Government today released the report of the Emissions Trading Scheme review panel, which was tasked with looking at the progress and future of the scheme designed to reduce greenhouse gas emissions by putting a price on emissions.

The report “Doing New Zealand’s Fair Share: Emissions Trading Scheme Review 2011” was released today and recommended that the implementation of some aspects of the ETS be slowed.

The report “Doing New Zealand’s Fair Share: Emissions Trading Scheme Review 2011” was released today and recommended that the implementation of some aspects of the ETS be slowed.

The SMC sought reaction to the panel’s recommendations from climate policy experts and scientists. Please feel free to use the quotes below. Further comments received will be added to the SMC website.

To speak to an expert on the ETS, please contact the SMC.

Dr Euan G. Mason, Associate Professor, School of Forestry, University of Canterbury, comments:

“The weakening of the scheme and the continued divergence in timings and rules for different sectors is unwelcome, particularly as the large carbon emission subsidy for agricultural emissions serves to keep land prices unrealistically high and reduce potential for afforestation to sequester carbon.

“However there are some very helpful suggestions relating to forestry. Offsets for deforestation of pre-1990 forests after 2012 would partly address inequities imposed on owners of those forests by the ETS’s deforestation liability. Allowing averaging as an option may bring more post-1989 forest owners into the scheme because their perception may be that risk is reduced. Self-insurance to mitigate risk is also welcome, but there may be some objections if it becomes mandatory.

“Many owners of forest areas less than 100 ha might benefit from measuring carbon sequestration instead of relying on conservative regional table estimates, and this will require changes to the carbon sampling scheme that has been designed by the Ministry of Agriculture and Forestry because more intense sampling of small areas is likely to be necessary in order to secure reasonably precise estimates of sequestration. Reading between the lines and considering the panel’s suggestions for pre-1990 indigenous forest, it seems that some reconsideration of the rather artificial 1990 boundary for forest classification within the ETS might occur, and that would be excellent.”

Professor Martin Manning, Climate Change Researhc Institute, Victoria University comments:

“New Zealand’s Emission Trading Scheme Review makes some recommendations that are intended to develop a smoother transition towards taking responsibility for our greenhouse gas emissions, but at the same time it has no clear focus on the long term goals.

“This review has recognised that delays in reaching long term international agreements should not be used as a reason for delays in national planning, and it also specifically notes that there will be an increasing requirement for us to take responsibility for our emissions. A more gradual transition period is proposed before the price of carbon emissions reaches $25 per tonne, but then it compensates for that by recommending that the price should continue to increase by $5 per tonne each year after 2013.

“However, there is still no direct link to the 50% emission reduction target that government has said should be achieved by 2050, even though many climate scientists say this would not be enough for a developed country. Nor does the review provide a response to the International Energy Agency’s report in March, which had said that New Zealand needs to assign clearer priorities for working towards these emission reduction goals. ”

Associate Professor Ralph Chapman· Director, Graduate Programme in Environmental Studies, Victoria University, comments:

“The dramatic scale of the climate change problem facing us is not being translated into credible policy. Much of the Review Panel’s analysis is reasonable, but its conclusions are predictably over-cautious. I commend the Panel for noting that:

- A clear long-term price signal is critical.

- Some businesses are already planning to cut their emissions in sectors where other businesses have claimed no such options exist.

- Agriculture should enter the ETS on the current legislated timescale (i.e. not have entry delayed past 2015).

“However, the Panel proposes further incremental weakening of the ETS’s already weak approach. Its proposed smoothing-out of price increases from 2013 postpones the day when emitters face a more realistic price on carbon – a price in any case way below what is needed to adequately cut emissions globally. And the Panel’s go-lightly approach for agriculture also underestimates that sector’s ability to find creative ways to cut emissions.

“The fundamental problems which the Review Panel fails to address are:

- That the timing of the transition to a low-carbon economy is now lagging badly behind what scientists (and international policy experts) are telling us about the steady accumulation of massive climate risk.

- The transition favoured by the Panel would not even attain the Government’s ’50 by 50′ goal (50% reductions by 2050) without drastic additional measures.

- There is a natural tendency for emitters to put off investing in abatement practices and technologies until they have to ‘face the music’, so postponing the music doesn’t help the transition needed.

“Measures such as fiddling with the free allocation phase-out so that it provides a ‘clear’ path of phase-out over 91 years is laughable. It should be remembered that – as with the Kyoto Protocol – an international regime that requires emissions to abate rapidly in future will mean there is a very high cost imposed on taxpayers by insufficient emitter abatement.”

Cath Wallace, Senior Lecturer in Economics & Public Policy, School of Government, Victoria University:

“The ETS Review Panel report notes the low impact of the ETS and its lack of impact on incentives to reduce greenhouse gas emissions, its lack of impact on emissions, and the very limited cost and competitiveness impacts. The Panel has canvasses a good many issues and some of the details of the scheme, which have caused particular problems, for instance to Maori forestry interests.

“The Panel makes many recommendations that mostly amount to slight increases in the clarity and effectiveness of the scheme. What it fails to do is to tackle the overall lack of effectiveness and ambition of the scheme or to note that the scheme fails to deliver the serious emissions reductions the science shows that we need to make.

“The panel also does not dwell on the significant economic losses that New Zealand will face from being a laggard and allowing falsely weak carbon prices to persist. This mis-pricing will lead to mis-directed investment and long term poor investment strategies because of such weak carbon price signals.

“Some slight increase in carbon price signal strength, such as gradually loosening the emissions price cap and reviewing the two credits for one emission credits paid for is welcome, but the response is too cautious, even though the laggardliness of New Zealand’s performance is noted by the Panel (p21-25). The price cap is not immediately impacting because of the two for the price of one rule, and the immediate removal of the 2:1 rule could have given the scheme much needed leverage on incentives and emissions abatement behaviour. Instead that rule is recommended to be only gradually phased out, leaving significant burdens on the rest of the population who are powerless to take the needed action to reduce these sectors’ emissions.

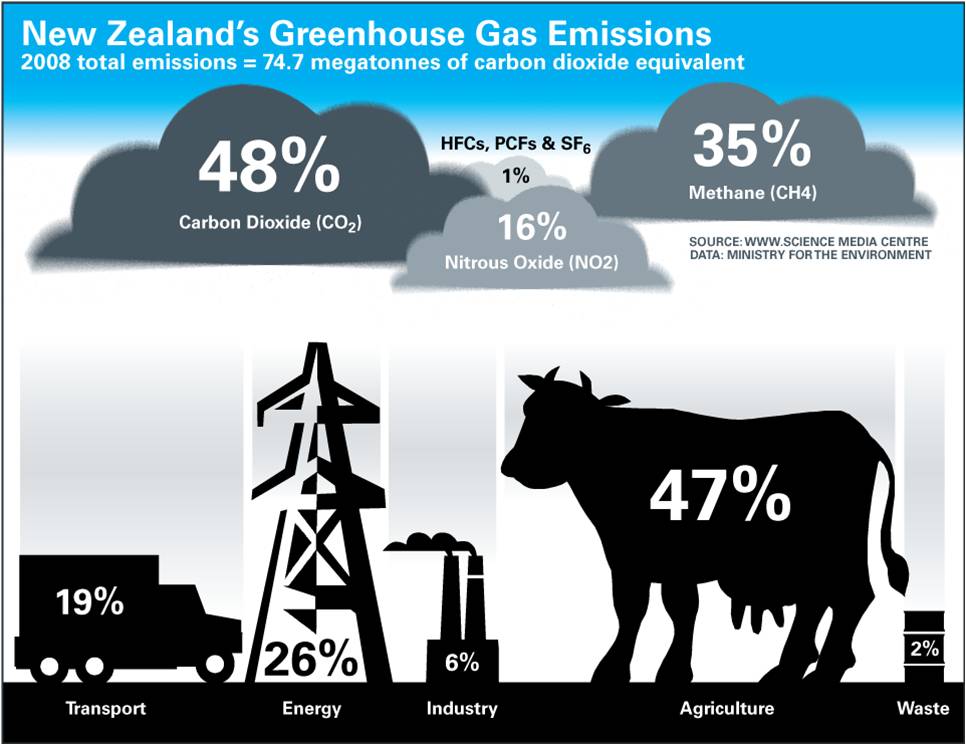

“It is inadequate to continue to postpone the introduction of agriculture to the scheme, given it accounts for nearly 50% of New Zealand’s CO2-equivalent emissions, and there is no recommendation for a significant increase in the rate at which agriculture should pick up its share of the burden – and just as importantly, face the incentives to reduce emissions.

“There is little justification aside from political caution too for the refusal to recommend a quantity cap on emissions, in line with the NZ Kyoto obligations.

“The inequity of the burden on different sectors that emit greenhouse gases is amply demonstrated in Tables 3.2 and 3.3 of the report, but the burden on taxpayers is not so clearly drawn.

“The Panel contained an array of people with strong links to emissions intensive industries, so it is little wonder that its recommendations are weak and it pays limited attention to the extent to which taxpayers are having to carry the burden of paying for pollution that they have no ability to reduce, while those who could reduce it have no incentive to do so.”